COVID-19: Navigate the exit from lockdown

Tim Watmough

The Covid-19 pandemic has had a truly unique impact. Economies worldwide have all but shut down as governments have sought to halt the spread of the virus and prevent potentially disastrous consequences by locking down and imposing social distancing measures on their populations. Not since the Black Death has a disease so profoundly switched off the everyday machinations of economic activity!

In the UK and other developed economies, companies perceived as not providing essential services have been compelled to run their activities remotely and where that is not possible to cease trading for an indefinite period and mothball their activities, so destructive is the nature of this virus. It does not take an economist to understand that it doesn’t take long for this level of economic shutdown to drive many individuals and companies to the edge of insolvency. For many the tolerance period is only a matter of weeks.

As with all extraordinary events, there are winners and losers. Some businesses have benefited from the lockdown measures, such as the supermarkets, ecommerce and video conferencing as consumers change their buying patterns and people communicate and work differently. However, the consequences of the damage to most companies will pose huge challenges in the struggle to survive. They have seen their revenue streams turned off for reasons beyond their control. Some will not survive and for those that do, there are the immense challenges of the prolonged phasing to exit lockdowns as well as the difficulties they face in their supply chains. Many of these are now not only disrupted but are broken and must be repaired.

The pandemic appears to have peaked in May in countries across mainland Europe and more recently the UK. In the Far East, due to the outbreak materialising earlier, the peak occurred about two months earlier.

In the UK, the R level remains ominously close to the critical topple level of “1.” The statistics do not exist, but the consensus is that less than 5% of the population have developed immunity. The UK is not unique in this sense and it is obvious that the potential for a second wave is a real danger. The conundrum around returning to more normal levels of social activity and thus economic activity is not straight forward.

With the requirement of circa 85% of the population to achieve Herd Immunity and the requisite vaccination campaign a long way off despite huge efforts the world over (a fully tested vaccine seems to be at least a year away), the next year will present a range of difficulties for companies to reinvigorate revenue streams.

It is evident both socially and economically that lockdowns cannot be left to run as they have. The longer the lockdown, the harder it will be for the economy to recover. To address this, the UK government is already making small gestures towards releasing lockdown; but so far these concessions have been more social and the difficult journey of phasing the economy back to health has not quite begun in earnest.

In the meantime, banks and companies have no choice, but to adapt and manage the risks they are presented with in the current paradigm. In the world of corporate debt, banks must find a way to project and understand their credit exposures across sectors. Similarly, companies must be able to understand and manage their cashflows in a dangerous new world where their exposure is spread upstream and downstream across the supply chain.

What are these new challenges facing Banks and Companies?

Governments were forced in the earliest phases of the pandemic to rapidly develop solutions to mitigate the downturn. In response to the liquidity issues to companies from ceasing or scaling back their operations, they required the banks to supply bridging finance via loans and subsidies to large and small firms to carry them during lockdown.

This has created pressure on banks to process a considerable number of requests whilst also managing their current long-term exposures, liquidity, and capital buffers. Measuring and projecting the potential of default ratios (PDs) across sectors in the light of specific economic factors is crucial for them to exit the crisis as cleanly as possible.

Specifically, they need to repurpose the econometric cash flow sequencing used to generate scenarios to create PDs. This will enable them to “deep dive” into specific sectors, ranging from supply chains in wholesale to end consumer businesses.

Companies of all sizes provide the essential life blood for any national economy. Accordingly, they are on the front line of policy makers solutions. At the same time, they are exposed more than anyone to policy uncertainty and lockdown exit risk.

Sequencing how and when different industries become economically active will create imbalances in the supply-demand dynamic. Companies will be impacted differently depending on what they do. They are particularly susceptible to the timing around the continuation and nature of social distancing measures and how they affect their activity.

Planning is essential; banks have provided credit to cover them in the short term and are watching closely to see when their cashflow becomes positive again. Having had their ability to generate revenue severely curtailed they must now analyse how to navigate back into the black. To do this they also need to understand their econometric cash flow sequences to create scenarios via which to build their road map.

How to Generate the Scenarios!

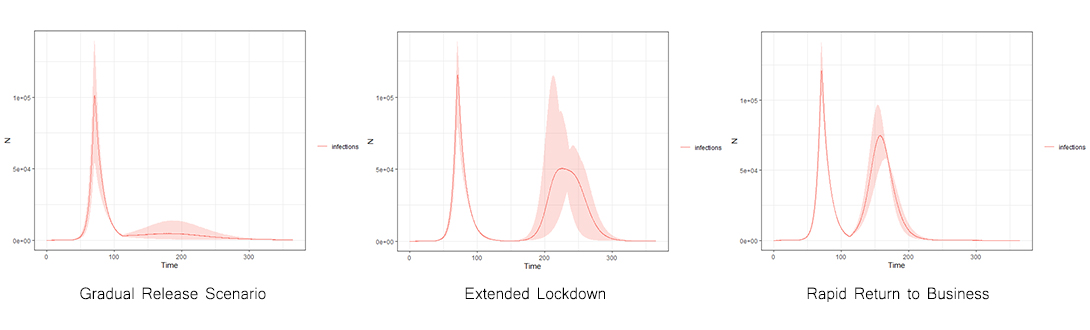

The first step towards developing a plan is to generate scenarios based on the epidemiological risks driven by the government’s lockdown exit strategy. Noted as probably the most accurate of its kind,

Imperial College’s model quantifies the spread of the virus across scenarios, factoring in social participation and the socio-economic activities of people that can alter the curve.

Figure 1: For illustration only

The model enables a flexibility to react to new risk factors including infection rates and mortality demographics as well as changing risk factors such as geographic concentrations.

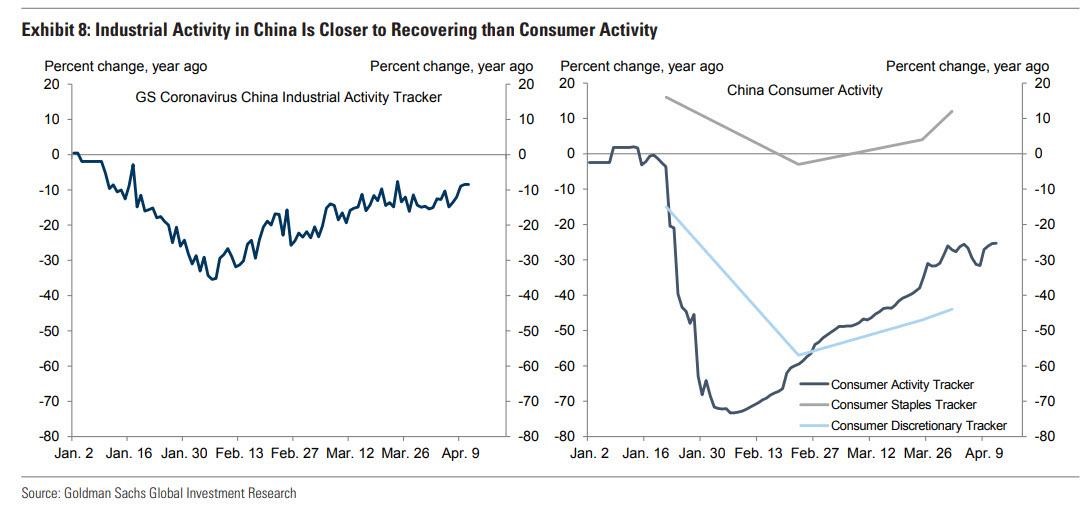

The next step is to integrate the epidemiological model with the relevant economic data. The only issue being that this pandemic is a first of its kind in modern times and data is therefore limited. That being so, the UK is fortunately behind many countries in the evolution of this pandemic. Firms in the country are therefore able to utilise data from countries ahead of it in the cycle, including several Asian countries, which are two to three months in advance as well as continental European countries running three to four weeks ahead.

This means that with the right help, banks and corporates in the UK can access and use performance data generated by companies in Asia and Europe to develop scenarios around different sectors in the UK (the same applies to the US and Canada). From this it is possible to model and forecast the oncoming supply and demand dynamics for different sectors and subsectors.

Figure 2: For illustration only

The net result is that banks with corporate loan businesses and large companies will be able to reassess their risk as new information on global infection rates and new exit strategies emerge.

From the banking perspective this will give the ability to understand the sensitivity of sectors to different exit scenarios enabling them to formulate stress scenarios around the credit risk factors to estimate the impact of PDs as well as develop a better prediction for Loss Given Default in their books. For companies, this will enable the calibration of Covid-19 and lockdown exit scenarios to their expected cashflows to facilitate informed dialogue with their creditors on their projections across the short and long terms. The timing and sequencing of the country’s exit strategy is a vital consideration for corporates that have reached or are nearing their credit limits.

In either case, because new data will continue to flow in from across the world as economies exit lockdown, banks and corporates that adopt a modelling solution of this kind will be left with a dynamic data pipeline that will enable them to regularly reassess and stress test their exposures.

Whist this article is focused on explaining why such a modelling strategy is beneficial to banks so that they can predict and manage their credit risk exposures and to corporates to stress test realised cashflows, the methodology and insight can also be used for different reasons by institutional investors. Having already adopted ESG analytical tools to deliver alpha in a world of changing priorities, asset management firms would also see value in adopting a toolkit like this, to better inform their portfolio management decisions.

Holley Holland together with its partner, Quant Foundry Limited, provides solutions that utilise the latest thinking and modelling expertise across the climate change / TCFD and ESG arenas.

About the author

Tim Watmough has over 20 years of experience working with clients focused on mathematical finance, including banks, asset & hedge fund managers, brokers, exchanges, CCPs and infrastructure providers.

He worked initially in executive search in which as an entrepreneur he built international businesses focused across front office, risk & regulation as well as the manage the bank paradigm – ‘’return on capital & return on equity’.

He now leverages his experience and contacts to originate and develop solutions in the overlap of advisory and managed services, executive search and project focused staff augmentation.